Travel insurance is more important now than ever, and a policy including a Cancel For Any Reason (CFAR) provision is a great way to add extra protection to your vacation.

Most policies offering this type of coverage require purchasing the insurance within 14 days of the initial deposit on your trip.

This benefit includes reimbursement of prepaid portions or deposits made before your trip.

What is Cancel for Any Reason Travel Insurance?

This benefit covers your trip if you need to cancel it, and penalties will be incurred. The CFAR travel insurance benefit covers any cancellation penalties from a travel retailer.

The premium paid for a travel insurance policy varies based on numerous factors, including the traveler’s age, the company, and the specific certificate of coverage.

| A quick look at TripInsurance.com, a travel insurance comparison website, showed that a CFAR policy is priced about 40 percent higher than a standard medical and travel policy. However, the benefits of CFAR coverage — if needed — far outweigh the additional cost. Important Note: Do not assume you have a CFAR benefit on your travel insurance policy. The amount you get back under a CFAR benefit can vary. |

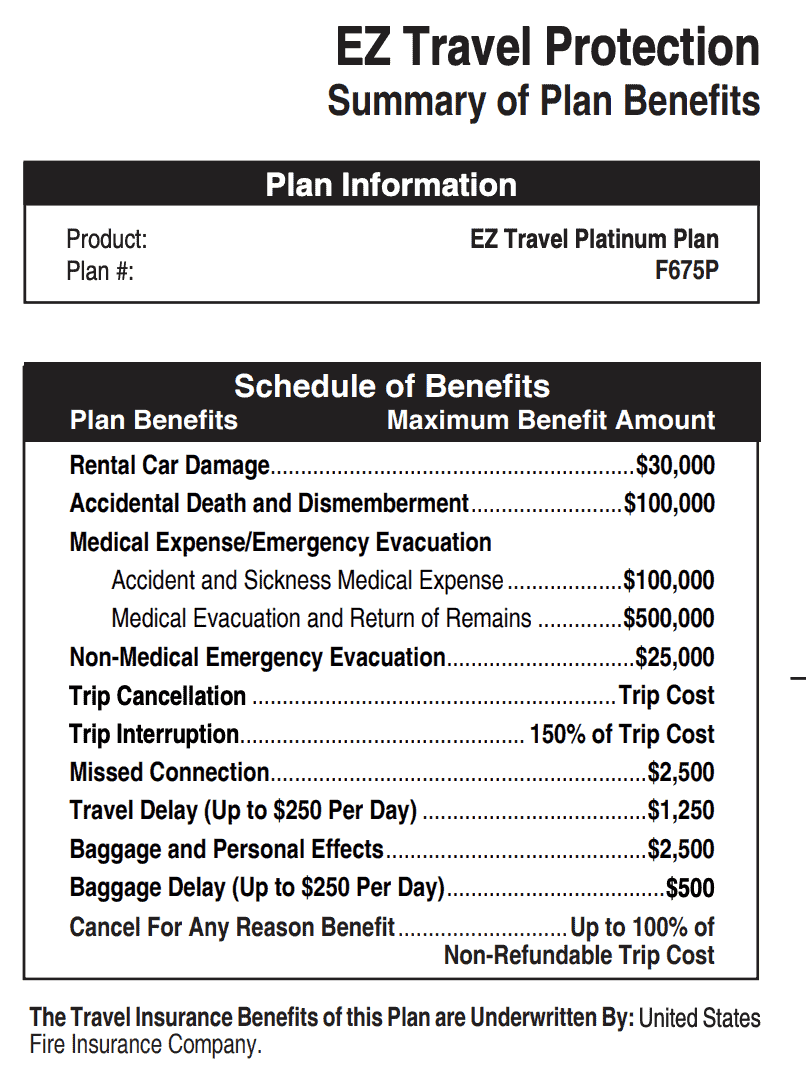

Some plans are designed to cover 75 percent of your costs, while others will provide up to 100 percent coverage. As always, it’s important to read the fine print to understand exactly what your policy does — and doesn’t — cover.

If you do not purchase a CFAR benefit as part of your trip insurance plan, your travel insurance claim could be denied.

Who Should Buy Cancel for Any Reason Trip Insurance?

Unforeseen circumstances don’t discriminate — whether a worldwide health crisis or simply deciding you’re uncomfortable traveling. Having the option to cancel your vacation and avoid losing thousands of dollars is, as the old credit card commercials used to say, priceless.

If you have travel plans coming up, it’s a good idea to protect your vacation now because the landscape can change.

| Dan Skilken, president of TripInsurance.com, told us, “Insurance companies could start adding provisions to restrict their risks in these plans.” The good news is that this won’t happen overnight. Skilken continued, “It’s going to take some time because insurance companies must refile with all 50 states to modify a plan or rates.” |

Be cautious when purchasing trip insurance through a cruise line or airline, as these policies do not typically include CFAR clauses and tend to focus more on medical or transportation-related issues. While group policies might offer lower costs, they also come with limited coverage.

Trip Insurance Policy Exclusions and Conditions

Just as you can’t buy an auto policy after wrecking your car and expect the insurance to cover your accident, the same logic applies to a CFAR benefit. It needs to be purchased within a set time of making the initial deposit for your trip. Otherwise, someone could try to buy the policy right before canceling just to take advantage of the benefits.

The CFAR provision typically expires a few days before the start of your trip. This doesn’t mean your policy becomes null — only the CFAR benefit.

Below is an excerpt from the certificate of coverage explaining this:

Your coverage automatically ends on the earlier of: 1) 48 hours prior to the scheduled departure time on the Scheduled Departure Date of Your Trip, or 2) the date and time You cancel Your Trip.

Before purchasing the policy, review the certificate of benefits to know exactly what you’re buying. The last thing you want is to submit a claim only to discover that your policy doesn’t cover your particular issue.

Your insurance provider can answer technical questions you may have regarding the policy and can also help you compare plans.

It’s important to ensure that the entire trip cost, not just the deposits paid toward your trip, is subject to cancellation penalties. This differs from other travel insurance products that allow you to insure only the deposits paid to date.

If you don’t declare the entire cruise cost upfront when purchasing the plan, you risk losing your CFAR benefit.

This creates a unique issue: if you make a $500 deposit on a $7,000 cruise and then buy a CFAR plan, you could pay more for the insurance than you’ve paid in deposits.

Important Things to Remember

Before purchasing your CFAR plan, keep these things in mind:

Before purchasing your CFAR plan, keep these points in mind:

- Purchase early: It’s best to purchase your trip insurance with CFAR coverage at your initial trip deposit.

- Cover everything: Include the full trip cost, including airfare and hotels, when comparing plans. This includes all payments and deposits made toward your vacation. Cutting corners to save on the premium could leave you underinsured when it’s time to file a claim.

- Read the fine print: Every insurance company’s policy is different, so it’s crucial to read the summary of benefits and all fine print carefully.

- Transfer policies if necessary: If the cruise line or tour operator cancels your trip and you’re given a credit or voucher for future travel, contact the insurance company to transfer your policy to the new trip.

- Know the difference: CFAR only pays 75% of your cancellation penalties if you cancel without a covered reason. For covered reasons, standard insurance applies.

- Check your existing coverage: If you have an annual insurance plan or rely on your credit card’s travel insurance, ensure you’re adequately covered. Most of these plans don’t include CFAR-type coverage.

Yes, purchasing a CFAR benefit can raise the premium, but the peace of mind it offers could be worth the investment.