A Minnesota resident who won a free cruise received a $47,000 medical bill from Norwegian Cruise Line (NCL) after being treated for the flu.

Mike Cameron was enjoying a weeklong Caribbean cruise with his girlfriend, Tamra Masterman, when he came down with a case of the flu.

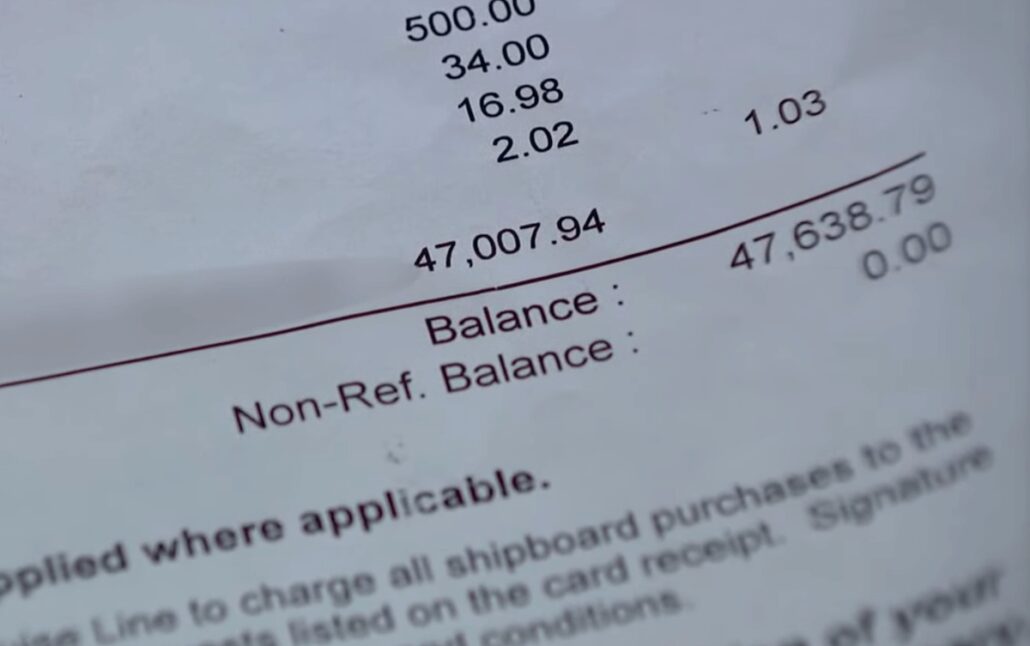

Cameron sought treatment from the Norwegian Encore’s medical facility and recovered three days later. However, he wasn’t expecting a medical bill worth tens of thousands of dollars, especially since he signed up for the cruise operator’s travel insurance.

To settle his account, Norwegian Cruise Line automatically maxed out two of their credit cards but Cameron says he still owes the company $21,000.

“I don’t know how I’m gonna ever pay them off. I’m gonna have to but I don’t know how,” he admitted in an interview with FOX 9.

Medical Staff Assured Him of Coverage

Cameron recalled how he was reassured by the medical staff onboard and reminded of his insurance coverage as he received treatment. “Everybody in the medical ward said, ‘Don’t worry you’ve got $20,000 coverage. You’ll be just fine,’” he narrated.

Contrary to their advice, Cameron’s health and travel insurance have yet to approve his claim. His girlfriend, Masterman, explained, “Well, the traveler’s insurance doesn’t want to pay it until we run it by our health insurance and the health insurance doesn’t want to pay it because it’s abroad.”

NCL’s Booksafe Standard Travel Protection Plan mentions a $20,000 maximum reimbursement “if you get sick or injured on your trip;” however, no other conditions are stipulated.

Norwegian Responds

The cruise line responded to the couple, describing their charges as “fair,” “reasonable,” and “closely comparable to other cruise lines.” When the news network reached out to them, a representative informed FOX9 they were looking into the matter.

Cameron and Masterman joined Norwegian Encore’s Caribbean cruise from Miami, Florida last January 5. After calling on Amber Cove, St. Thomas Island, Tortola Island, and Great Stirrup Cay, the vessel returned to Miami on January 12.

The recent incident is a sobering reminder that insurance policies must be reviewed carefully, particularly their exclusions and conditions. From medical evacuations that cost $150,000 to $2,000 fees for seasickness, travel insurance can make a big difference to passengers’ physical and financial health.