A Colorado woman discovered a $12,000 surprise bill following the sudden death of her husband. Patty Layman found her husband had booked a surprise cruise vacation just days before his death.

This was the start of a bad experience for her in dealing with the cruise line to get a refund.

Widow sought a full refund for cruise

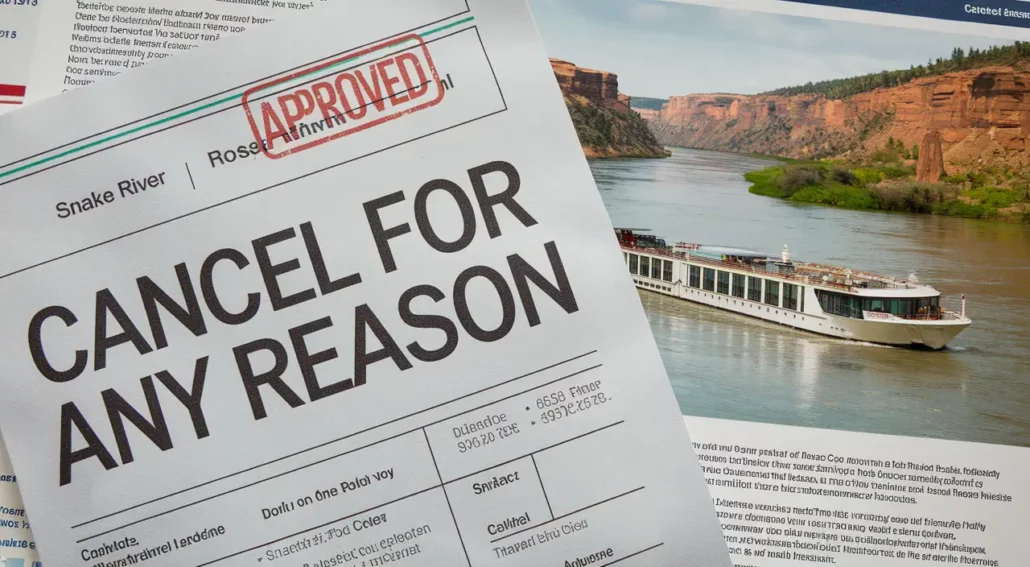

Expecting a full refund due to husband Dick opting for the “cancel for any reason” travel insurance policy, American Cruise Lines informed her she wouldn’t be getting a full 100% refund.

The terms and conditions state a full refund is only applicable if canceled 90 days before. Dick Layman had died 73 days before the scheduled departure.

As since it was less than 90 days before departure, American Cruise Lines would only refund 80% of the amount and charge a $250 administrative fee per passenger.

Dick Layman had booked a 10-day cruise on the Columbia and Snake Rivers, likely as an anniversary surprise, Patty said.

Buried in fine print

She was surprised at the cruise line’s rigid approach to adhering to the terms and conditions to the letter. “In case we had to cancel, you’d still get your full payment back. That’s what it meant to me,” she said. She was shocked at the inflexibility and wrote directly to the CEO, but “I never even got a reply back,” she said.

Read More: Should I buy travel insurance?

After months of communication with the cruise line, Patty sought assistance from local TV station 9 News.

Despite multiple attempts, the news outlet received a response from ACL but was unable to secure a full refund for Patty. Ultimately, she received a check for $9,000 out of the total cost of the cruise, which was $12,000.

“They could have done it the right way,” she said. “They could have made a bad situation better, and they haven’t.”

Is Cancel for Any Reason Travel Insurance Worth it?

Cancel for any reason (CFAR) travel insurance can offer peace of mind to cruisers, but it’s important to understand the limitations before buying.

Unlike standard travel insurance, CFAR provides broader coverage, allowing travelers to cancel their trip for virtually any reason not covered by typical policies.

Dan Skilken, President of TripInsurance.com, told us to read everything before purchasing a CFAR travel insurance policy. “Some cancel for any reason plans only reimburse 50% to 75% of the trip cost, and certain terms apply,” he said.

For instance, most CFAR policies require travelers to purchase the plan within a short window after making their initial trip deposit, often within 14 to 21 days.

While CFAR can offer flexibility, it’s critical to read the fine print and be aware of potential administrative fees, which some cruise lines may still charge even with this coverage.