Shares of major cruise lines sharply declined on Thursday after U.S. Commerce Secretary Howard Lutnick announced that the Trump administration plans to require cruise companies to pay their share of U.S. income taxes.

The move, which would end a long-standing industry practice of registering ships under foreign flags to avoid domestic tax obligations, sent investors into a sell-off, but slightly rebounding by noon.

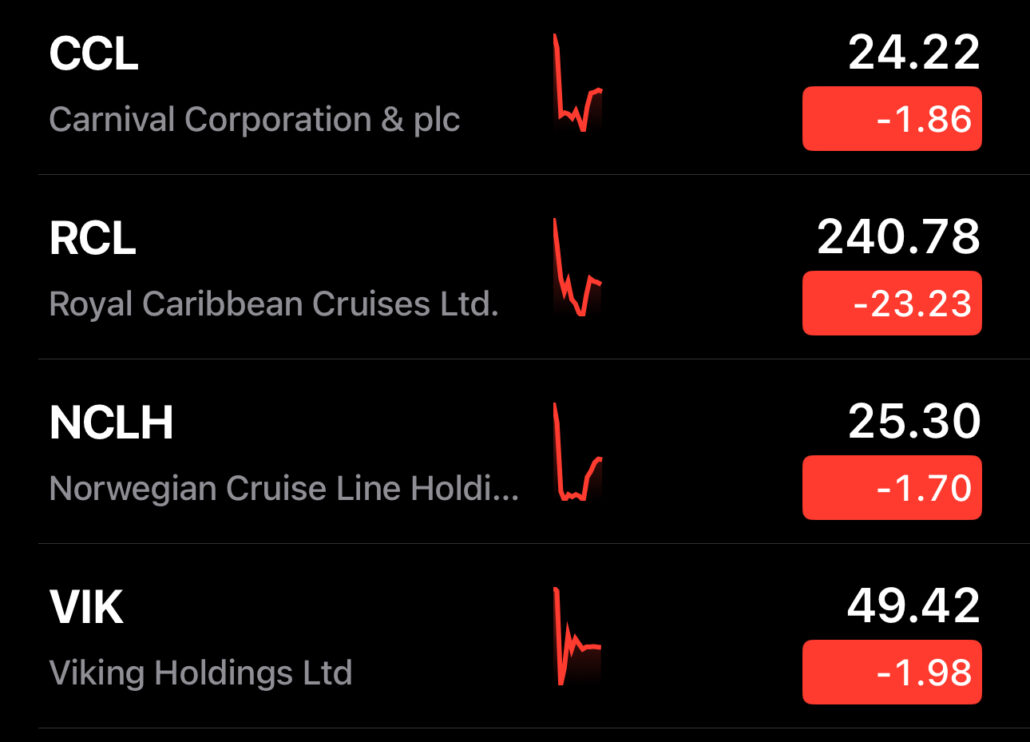

Carnival Corporation (CCL), Royal Caribbean (RCL), and Norwegian Cruise Line Holdings (NCLH) saw their stocks decline between 7% and 11% in early trading.

Viking Holdings (VIK) also took a hit, dropping nearly 4%. Lutnick’s comments, made Wednesday night on Fox News, signaled that the administration would seek to close tax loopholes that have historically allowed cruise operators to avoid U.S. corporate taxes.

“You ever see a cruise ship with an American flag on the back?” Lutnick said. “None of them pay taxes… This is going to end under Donald Trump, and those taxes are going to be paid.”

Fact Check: Do Cruise Lines Pay Their Share of Taxes

He added that the tax revenue collected from cruise companies would contribute to lowering tax rates for American citizens.

The sell-off comes as the cruise industry already faces growing financial pressures, including rising fuel costs and regulatory changes.

Oil prices have surged more than 16% from 2024 lows, while a UBS report noted weakening demand for cruise departures from California, partly due to wildfires, and a slowdown in Canadian bookings caused by a strong U.S. dollar.

Despite investor concerns, analysts at Stifel Financial called the stock declines a “massive overreaction,” pointing out that similar tax proposals have surfaced multiple times over the past 15 years without advancing.

They also noted that the cruise industry is categorized under cargo shipping in U.S. tax policy, making regulatory changes difficult without broader reforms affecting global trade.

If implemented, analysts warn cruise lines may relocate their corporate headquarters outside the U.S., further reducing American-based jobs.

Industry experts say how the administration would enforce new tax regulations on companies operating largely in international waters remains unclear.

While the announcement has rattled the market, Stifel advised investors to view the pullback as a buying opportunity, citing continued strength in post-pandemic cruise demand.

The last attempt at tax reform for the cruise industry occurred in 2017 but was unsuccessful.